Planned Giving

Estate Planning / Gifts of Stocks and Mutual Funds

Contact Form

For questions or more information, contact our Director of Development.

Estate and Gift Planning

Africa Inland Mission recognizes your desire to have a part of making Jesus known among Africa’s unreached peoples through planned giving. We provide a number of planned giving opportunities to enable you to leave a legacy that will impact generations for the cause of Christ.

Methods of Planned Giving

Africa Inland Mission provides a number of estate and gift design options to help you put your house in order and provide for the people and ministries you love through:

- Outright Gifts

- Charitable Gift Annuities

- Trusts

- Life Insurance

- Bequests & Testamentary Gifts

Gifts of Stocks and Mutual Funds

1

You transfer securities to Africa Inland Mission.

2

Africa Inland Mission sells your securities.

3

AIM directs the funds to the ministry of your choice.

A gift of appreciated securities (those held more than a year) is an excellent way to support the ministry of Africa Inland Mission and receive tax benefits.

Transferring appreciated securities is attractive to many people because of the significant tax savings. Contributing appreciated securities has potential benefits that include avoiding capital gains tax, receiving a charitable income tax deduction and possible increase in income.

Africa Inland Mission is grateful for the gifting of appreciated securities from our donors. We recognize the impact of such a gift and the opportunities it provides for the present and future ministry of Africa Inland Mission.

Benefits

- Receive a charitable income tax deduction based on the full fair market value of the securities.

- Avoid capital gains tax otherwise due upon the sale of the appreciated stock, bonds, or mutual funds.

- Designate your gift to a project, campaign, or specific fund.

- Your generosity supports the ministry of Africa Inland Mission.

Always consult with your attorney, accountant, or advisors for the legal and tax implications before making a major charitable contribution.

Charitable Gift Annuities

1

You transfer assets as a gift to Africa Inland Mission.

2

You or one other beneficiary receives a fixed amount of income for life

3

When terms end or on death of last beneficiary, remainder passes to Africa Inland Mission

A Charitable Gift Annuity is a legal contract between you and Africa Inland Mission. You transfer assets as a gift to Africa Inland Mission in return for a promise that Africa Inland Mission will pay to you (or one other beneficiary you name) a fixed amount of income for life.

When the terms of the contract end or upon the death of the last beneficiary the remaining amount passes on to Africa Inland Mission.

Benefits

- Lifetime Income Stream for one or two lives

- Immediate Tax Deduction

- Reduction of Capital Gain Taxes

- Property passes to charity with no probate fees or estate taxes

Always consult with your attorney, accountant, or advisors for the legal and tax implications before making a major charitable contribution.

A Donor Story: A Legacy in Action

By Margaret Wadham Swan

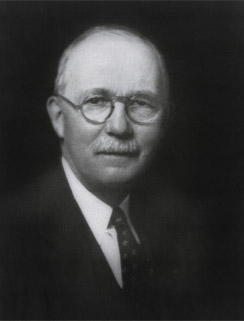

My family’s interest in the Africa Inland Mission (AIM) started in the early 1900s. My grandfather, Harvey Wadham, served as Vice President of AIM’s U.S. Council for the years 1926-34, and President from 1934 to 1942.

From his childhood, he had tithed 50% of his income and carried on that habit throughout his life, regardless of economic conditions. With an eighth grade education, he started a career on Wall Street as a teenage messenger, ending up a partner in the brokerage firm for which he worked – still tithing 50%. He was not only an astute businessman, but a constant and faithful witness to anyone with whom he came in contact, including strangers he met on the train into New York City each day. They all heard the Gospel.

In his forties, he was told he had an inoperable brain tumor, which would result in blindness in six months and death in a year. A group of Christian businessmen, known amongst themselves as “The Round Table,” gathered for a day of prayer on his behalf. In answer to those prayers, he went on to live until the age of 86. The Lord did not remove the tumor, but stopped its growth until his mid-eighties. I believe this was God honoring his total personal and financial dedication and personal conviction that all he had was the Lord’s.

Conscious that most of what I now have came from his faithful stewardship and God’s provision, when I started the process of creating a will I looked for a beneficiary that I knew had been of interest to him in his lifetime, and one that was faithful to the Gospel. Some organizations could not be located, and others I knew were now defunct or unsuitable. I volunteered for a time in AIM’s home office, then located in Pearl River, NY, to become more familiar with the mission. I was impressed with the commitment and dedication of the missionaries I met as well as the home office staff. After seeking God’s guidance, I believed that I was to make AIM my beneficiary to honor my grandfather’s memory and to the furtherance of the Great Commission which was primary in his life.